Category

Foreign Investment Fund

Investment Policy

o The Fund’s policy is to invest in or hold the investment units of the foreign mutual funds, for instance, CIS Units and/or Exchange Traded Fund Units from two funds and more in average in a fiscal year for not less than 80% of net asset value of the mutual funds. The policy of the investment in the said targeting fund is to invest in foreign equity instruments all over the world relating to the innovation-driving products and services under Smart Transportation System, such as Autonomous Vehicle Technology, Connected Vehicle Technology, drones which are commercially and militarily used, and/or transportation and travelling systems that will enter to improve more efficiency of travel and transportation system, including traffic system, and/or to gain benefit from the said innovation. Average investment proportion in each fund in a fiscal year is not more than 79% of net asset value of the Fund. However, the Fund invests in overseas, resulting in net exposure relating to average foreign risk in a fiscal year for not less than 80% of net asset value of the Fund or based on the ratio specified in the Notification of the Office of the SEC.

o The Fund primarily invests in the following foreign mutual funds exceeding 20% of net investment value of the Fund.

Fund Name: SPDR? S&P Kensho Smart Mobility ETF

Investment Policy

SPDR? S&P Kensho Smart Mobility ETF is the fund (“ETF”) with an Actively Managed characteristic. In a normal situation, the ETF invests at least 79% of net asset value of the ETF in the securities which are the components of S&P Kensho Smart Transportation Index (Underlying Index). The said Underlying Index consists of the shares of the trading companies in the US Stock Exchange. The investment in the global companies relating to the innovation-driving products and services under Smart Transportation System, such as Autonomous Vehicle Technology, Connected Vehicle Technology, drones which are commercially and militarily used, and/or transportation and travelling systems that will enter to improve more efficiency of travel and transportation system, including traffic system, and/or to gain benefit from the said innovation. Average investment proportion in each fund in fiscal year. The said ETF is administered and managed by SSGA Funds Management and its investment portfolio is semiyearly rebalanced.

o The Management Company reserves its right to change the type and special characteristics of the mutual funds in the future to a Feeder Fund or a Direct Investment in the instrument and/or foreign securities, or to reverse to a Fund of Funds without the increase of risk spectrum, subject to the discretion of the fund manager, based on the market situation, and the best interest of the unitholders. However, the Management Company will notify the unitholders at least 30 days prior to the change in the type of the Fund via the Notification on the website of the Management Company and the website of its broker (if any).

o Thai fund may invest in Derivatives to ensure more efficient portfolio management and/or hedging from foreign exchange rate risk based on the discretion of the Fund Manager.

o The fund may invest in investment units of mutual funds or real estate mutual funds (Fund 1) or real estate investment trusts (REITs) or infrastructure mutual funds (infra) which are managed by the management company in the proportion not exceeding 20% of the net asset value of the Fund, unless the destinated fund is real estate mutual funds (Fund 1) and infrastructure mutual funds (infra), the maximum investment is one third of the total investment units of the destinated fund. The investment in such investment units must be within the investment policy framework of the Fund in compliance with the criteria and conditions prescribed by the SEC Office. However, the destinated fund is unable to reverse the investment in the circle investment and is unable to make cascade investment in other funds under the same asset management.

Fund Management Strategy :

To expect the higher turnover than the index (Active management).

Dividend Policy

No

Benchmark

This fund will compare with the Morningstar Global Mkts Index NR USD yield in US dollars. Adjusted by exchange rate to calculate the return in Thai Baht as of the date of return calculation.Registration date

18 May 2021

Fund Manager Name

Ponlasin Kijmuntarvorn

Pornphen Chuleeprasert

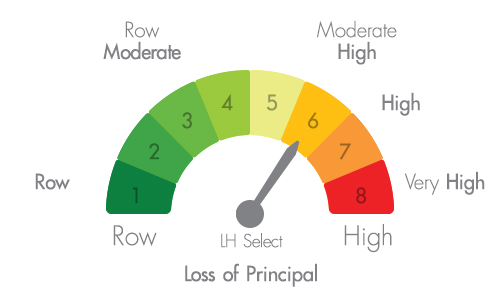

RISK RATE

NAV MOVEMENT

TRADING INFO

Land and Houses Securities Public Company Limited

or appoint selling agents