Category

Retirement Fund

Investment Policy

The Fund invests mainly in units of a foreign mutual fund (the “Master Fund”) that focuses on companies operating in the cybersecurity industry. On average, at least 80% of the Fund’s net asset value (NAV) in each accounting year will be invested in the Master Fund. The Thai Fund invests in the First Trust Nasdaq Cybersecurity UCITS ETF, Class A Accumulating – USD (the “Master Fund”), which is denominated in U.S. dollars (USD). The Master Fund is listed on the London Stock Exchange (United Kingdom), Deutsche B?rse Xetra (Germany), Borsa Italiana (Italy), and SIX Swiss Exchange (Switzerland). However, the primary exchange through which the Thai Fund invests is the London Stock Exchange in USD. The Master Fund is established under the laws of Ireland, regulated by the Central Bank of Ireland, and managed under the UCITS framework by First Trust Global Portfolios Management Limited.

The First Trust Nasdaq Cybersecurity UCITS ETF aims to achieve investment results that closely match the price and performance, before fees and expenses, of the Nasdaq CTA Cybersecurity NTR Exclusions Index (the benchmark index). The Fund Management Company reserves the right to change the exchange on which the Master Fund is traded and/or to change the base currency in the future, if deemed to be in the best interest of investors. Any such changes will be announced to investors in advance through official notices at the Fund Management Company’s offices, distributors, and/or relevant electronic media.

The remaining portion of the Fund’s assets may be invested, both domestically and internationally, in deposit-like instruments, bank deposits, bonds, equities, hybrid securities, warrants, securities, and/or other assets or investment methods as specified in the Fund’s prospectus and as permitted by the Securities and Exchange Commission (SEC).

The Fund may invest in derivatives to hedge against foreign exchange risk, at the discretion of the Fund Manager. The decision to hedge will depend on financial market conditions and other relevant factors such as economic, political, monetary, and fiscal conditions. If the U.S. dollar is expected to weaken, the Fund may increase its level of currency hedging. If the U.S. dollar is expected to strengthen, the Fund may reduce or not conduct hedging. However, if hedging is considered not beneficial to unitholders or may reduce potential gains, the Fund Manager may choose not to hedge. Investors should note that hedging involves costs, which may reduce the overall return of the Fund.

In addition to hedging, the Fund may invest in derivatives for efficient portfolio management or additional risk reduction, with foreign exchange rates as the underlying assets. This may help enhance returns and/or reduce overall fund expenses, in accordance with SEC regulations.

The derivatives entered into by the Fund will mainly use foreign exchange rates as their underlying assets. If any event affects the derivatives contracts or if a counterparty fails to meet its obligations, the Fund may not receive the expected returns or may incur losses. To manage this risk, the Fund Management Company carefully evaluates and continuously monitors the underlying assets and the creditworthiness of counterparties. The Fund focuses on transactions with counterparties that have investment-grade credit ratings.

The Fund may also invest in or hold structured notes, non-investment-grade debt instruments, unrated debt instruments, and securities of unlisted companies. In addition, the Fund may engage in securities lending transactions, reverse repurchase agreements, and other permitted investment transactions or assets in accordance with SEC regulations.

Dividend Policy

Benchmark

Registration date

26 November 2025

Fund Manager Name

Related Documents

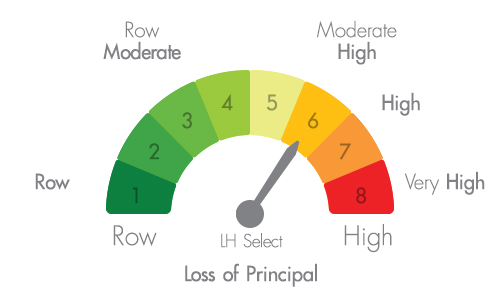

RISK RATE